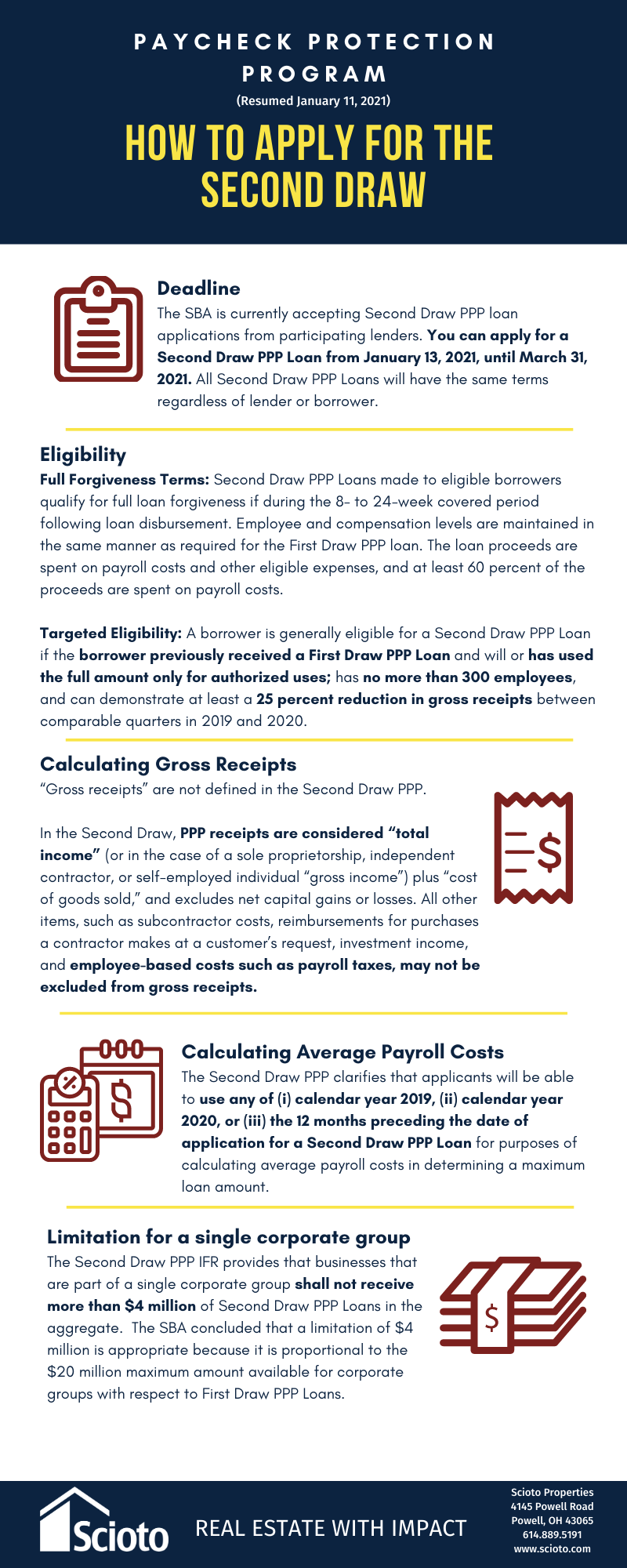

The U.S. Small Business Association (SBA) is currently accepting Second Draw PPP loan applications from participating lenders. You can apply for a Second Draw PPP Loan from January 13, 2021, until March 31, 2021. All Second Draw PPP Loans will have the same terms regardless of lender or borrower.

Some helpful hints before you apply:

- It has been our experience that smaller and mid-size banks have been far more responsive than the large national banks to PPP requests.

- Assemble your documentation before you apply. The loan process is fairly straightforward and should not take long if you have copies of your 2019 filed tax returns and operating statements for 2020.

- If you already have a PPP loan, check with your existing bank to see if they can process the application faster. You are not required to use the same lender, but often it is faster and simpler because they already have all or your information on file.

- If you already have a PPP Loan do not forget to apply for loan forgiveness! The deadlines are approaching. It is not required to receive a second loan, however many banks are encouraging borrowers to apply for forgiveness at the same time.

UNRESOLVED BORROWER DILEMMA

An otherwise eligible borrower applying for a Second Draw PPP Loan may find its application process adversely impacted if its First Draw PPP Loan is under review by the SBA and/or a determination has been made that the borrower in ineligible pursuant to PPP regulations or “information in the SBA’s possession.” The SBA defines such a borrower to be an “unresolved borrower,” and if the SBA notifies the PPP lender that the applicant for a Second Draw PPP Loan is an unresolved borrower, the SBA will not issue an SBA loan number, and additional loans are prohibited from being made to such borrower until the outstanding issues are resolved. The SBA states that it will “resolve issues related to unresolved borrowers expeditiously,” and that ongoing review by the SBA of an unresolved borrower does not disqualify an eligible unresolved borrower from receiving a Second Draw PPP Loan.

For more details from the Small Business Administration, click here.

Comment